The total money makeover: A proven plan for financial fitness. Google Sheets is quite user-friendly on my mobile phone so I can enter my spending on the go instead of asking for and keeping receipts for data entry later. Information that I input in the tracking sheet is automatically pulled into the budget sheet so that I can easily check whether I am on track with my income and expenses. I use Google Sheets to create my budget and tracking sheets. To make this work, I have schedule time for budget revision in my calendar. It also allows the inclusion of month-specific expenses. There should not be major changes, so it is going to be quick to adjust. Budget Step 5: Make a New Budget Before the Month Beginsĭave Ramsey advocates planning a new budget every month.

Dave ramsey percentages for budget update#

I can call it up to update anywhere I am. I have also set up a tracking sheet using Google Sheets. I’m down to debit card, cash, bank transfer and GIRO. I have decided not to use them unless I have to. I think it helps if there are fewer payment methods. I must account for everything that happens with my money all month long. To implement, I need to track every single income and expense. It is also not going towards spending on something I do not need nor value. It is not just sitting in a bank earning very little interest. My money goals could be saving for a vacation or a big purchase or debt repayment or investment. I would have assigned every dollar towards something. When I have done that, the balance should be zero. This is the time to re-allocate the extra money towards the money goals I set. For me, I am sure I am going have extra money left over.

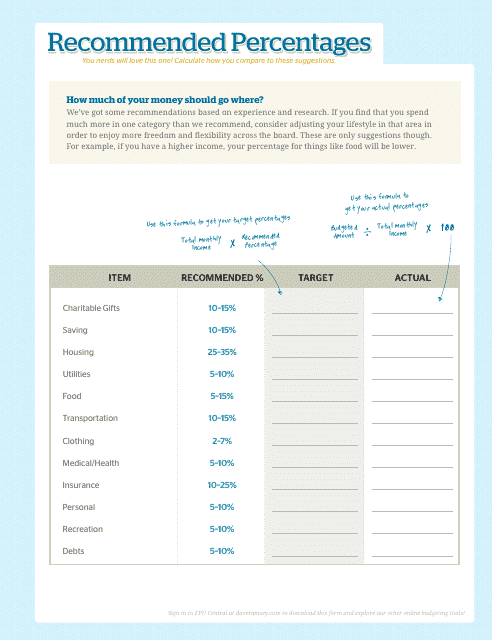

For example, 10% for giving and 15% for retirement saving. Assigning a percentage of household income for a particular expense. The next key feature is his recommended household budget percentages. I hope that by setting money goals based on the Baby Steps I am on will help me make better use of the money God gave me. When I try to invest, I often get impatient and choose the wrong things to invest in. Initially, I left them in my bank account with low interest rates.

My challenge is knowing what to do with the money I save. I find this idea intriguing – being intentional with money by assigning every dollar a job.

0 kommentar(er)

0 kommentar(er)